Revenue Act of 1921

Today we are going to talk about Revenue Act of 1921, a topic that has captured the attention of people around the world. Revenue Act of 1921 is a concept that has been the subject of debate and discussion in different areas, from politics to popular culture. In this article, we will explore the different facets of Revenue Act of 1921 and its impact on today's society. From its origin to its day-to-day implications, we will dive into a detailed analysis of Revenue Act of 1921 to better understand its importance and relevance in the modern world. Without a doubt, Revenue Act of 1921 is a topic that leaves no one indifferent, and its influence continues to grow as time progresses. Join us on this fascinating journey to discover more about Revenue Act of 1921!

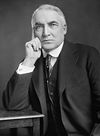

The United States Revenue Act of 1921 (ch. 136, 42 Stat. 227, November 23, 1921) was the first Republican tax reduction following their landslide victory in the 1920 federal elections. New Secretary of the Treasury Andrew Mellon argued that significant tax reduction was necessary in order to spur economic expansion and restore prosperity.

Mellon obtained repeal of the wartime excess profits tax. The top marginal rate on individuals fell from 73 to 58 percent by 1922, and preferential treatment for capital gains was introduced at a rate of 12.5 percent. Mellon had hoped for more significant tax reduction.

Tax on Corporations

In 1921 a rate of 10 percent was levied on the net income of corporations and 12.5 percent levied thereafter.

Tax on Individuals

A Normal Tax and a Surtax were levied against the net income of individuals as shown in the following table.

| Revenue Act of 1921 Normal Tax and Surtax on Individuals | |||||

| Net Income | Normal Rate | Surtax applicable to 1921 |

Surtax applicable to 1922 and thereafter | ||

| (dollars) | (percent) | Surtax Rate (percent) |

Combined Rate (percent) |

Surtax Rate (percent) |

Combined Rate (percent) |

| 0 | 4 | 0 | 4 | 0 | 4 |

| 4,000 | 8 | 0 | 8 | 0 | 8 |

| 5,000 | 8 | 1 | 9 | 0 | 8 |

| 6,000 | 8 | 2 | 10 | 1 | 9 |

| 8,000 | 8 | 3 | 11 | 1 | 9 |

| 10,000 | 8 | 4 | 12 | 2 | 10 |

| 12,000 | 8 | 5 | 13 | 3 | 11 |

| 14,000 | 8 | 6 | 14 | 4 | 12 |

| 16,000 | 8 | 7 | 15 | 5 | 13 |

| 18,000 | 8 | 8 | 16 | 6 | 14 |

| 20,000 | 8 | 9 | 17 | 8 | 16 |

| 22,000 | 8 | 10 | 18 | 9 | 17 |

| 24,000 | 8 | 11 | 19 | 10 | 18 |

| 26,000 | 8 | 12 | 20 | 11 | 19 |

| 28,000 | 8 | 13 | 21 | 12 | 20 |

| 30,000 | 8 | 14 | 22 | 13 | 21 |

| 32,000 | 8 | 15 | 23 | 15 | 23 |

| 34,000 | 8 | 16 | 24 | 15 | 23 |

| 36,000 | 8 | 17 | 25 | 16 | 24 |

| 38,000 | 8 | 18 | 26 | 17 | 25 |

| 40,000 | 8 | 19 | 27 | 18 | 26 |

| 42,000 | 8 | 20 | 28 | 19 | 27 |

| 44,000 | 8 | 21 | 29 | 20 | 28 |

| 46,000 | 8 | 22 | 30 | 21 | 29 |

| 48,000 | 8 | 23 | 31 | 22 | 30 |

| 50,000 | 8 | 24 | 32 | 23 | 31 |

| 52,000 | 8 | 25 | 33 | 24 | 32 |

| 54,000 | 8 | 26 | 34 | 25 | 33 |

| 56,000 | 8 | 27 | 35 | 26 | 34 |

| 58,000 | 8 | 28 | 36 | 27 | 35 |

| 60,000 | 8 | 29 | 37 | 28 | 36 |

| 62,000 | 8 | 30 | 38 | 29 | 37 |

| 64,000 | 8 | 31 | 39 | 30 | 38 |

| 66,000 | 8 | 32 | 40 | 31 | 39 |

| 68,000 | 8 | 33 | 41 | 32 | 40 |

| 70,000 | 8 | 34 | 42 | 33 | 41 |

| 72,000 | 8 | 35 | 43 | 34 | 42 |

| 74,000 | 8 | 36 | 44 | 35 | 43 |

| 76,000 | 8 | 37 | 45 | 36 | 44 |

| 78,000 | 8 | 38 | 46 | 37 | 45 |

| 80,000 | 8 | 39 | 47 | 38 | 46 |

| 82,000 | 8 | 40 | 48 | 39 | 47 |

| 84,000 | 8 | 41 | 49 | 40 | 48 |

| 86,000 | 8 | 42 | 50 | 41 | 49 |

| 88,000 | 8 | 43 | 51 | 42 | 50 |

| 90,000 | 8 | 44 | 52 | 43 | 51 |

| 92,000 | 8 | 45 | 53 | 44 | 52 |

| 94,000 | 8 | 46 | 54 | 45 | 53 |

| 96,000 | 8 | 47 | 55 | 46 | 54 |

| 98,000 | 8 | 48 | 56 | 47 | 55 |

| 100,000 | 8 | 52 | 60 | 48 | 56 |

| 150,000 | 8 | 56 | 64 | 49 | 57 |

| 200,000 | 8 | 60 | 68 | 50 | 58 |

| 300,000 | 8 | 63 | 71 | ||

| 500,000 | 8 | 64 | 72 | ||

| 1,000,000 | 8 | 65 | 73 | ||

- Exemption of $1,000 for single filers and $2,500 for married couples and heads of family. A $400 exemption for each dependent under 18. Married couple exemption is reduced to $2,000 for net income over $5,000.

References

- ^ "1921 Income Tax Act" (PDF). HiddenMysteries.org.